Engaging and Assessing our Natural Rubber Supply Chain

RESPONSIBLE RESILIENT NATURAL RUBBER

Supply chain assessments are an essential means of ensuring the implementation of Michelin’s Sustainable Natural Rubber Policy. To that end, Michelin has championed the adoption and even the creation of scalable assessment frameworks that are able to be used by a large proportion of the industry.

DIRECT SUPPLIER ASSESSMENTS

Michelin procures most of its natural rubber from independent suppliers. Collectively, independent natural rubber processing factories, groups of factories and traders buying from factories are known as direct or Tier 1 suppliers. In every case, Michelin conducts on-site audits, which through a successful pilot will now include environmental and labor aspects from 2021, on individual natural rubber processing factories before they are added to an approved factory list, and on a regular basis afterwards.

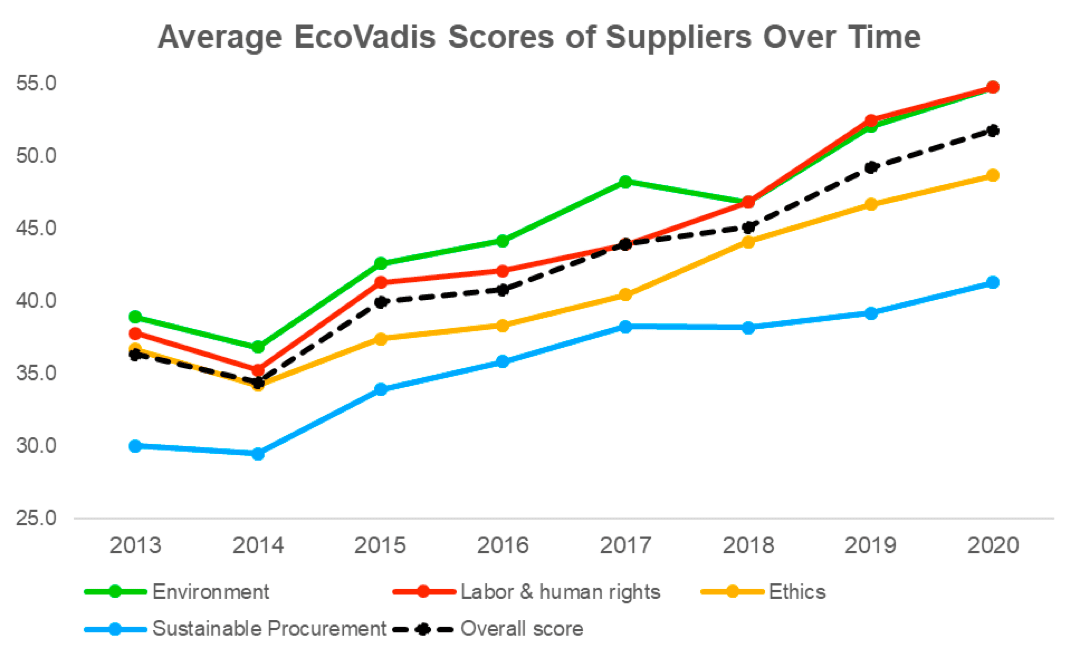

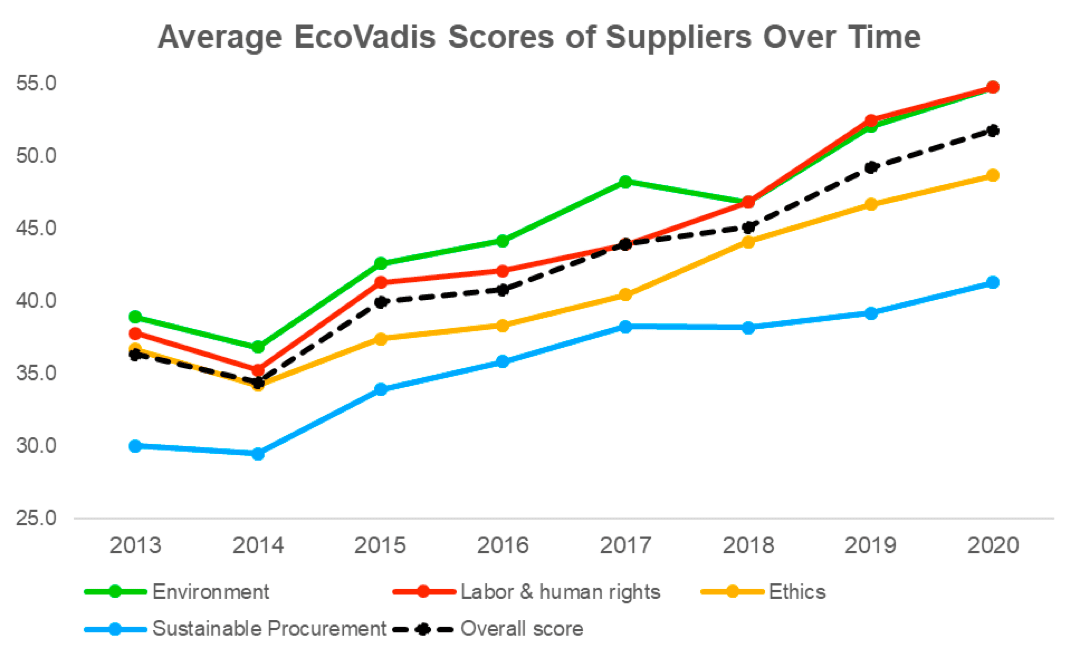

To holistically assess the majority of suppliers on their sustainability maturity, Michelin chose to leverage EcoVadis, a global business sustainability ratings provider to assess its direct suppliers in 2013. EcoVadis assesses the maturity of actions and systems related to sustainability by scoring the performance of suppliers in four themes: Environment; Labor and Human rights; Ethics and Sustainable Procurement. These assessments help Michelin to understand relative risk among its supply base and identify suppliers with weaker performance so that they can implement improvement plans. As a result of close engagement with suppliers and by championing the use of a common tool among the industry, EcoVadis assessments are now widely used across the natural rubber supply chain.

RESPONSIBLE PROCESSING AND PRODUCTION

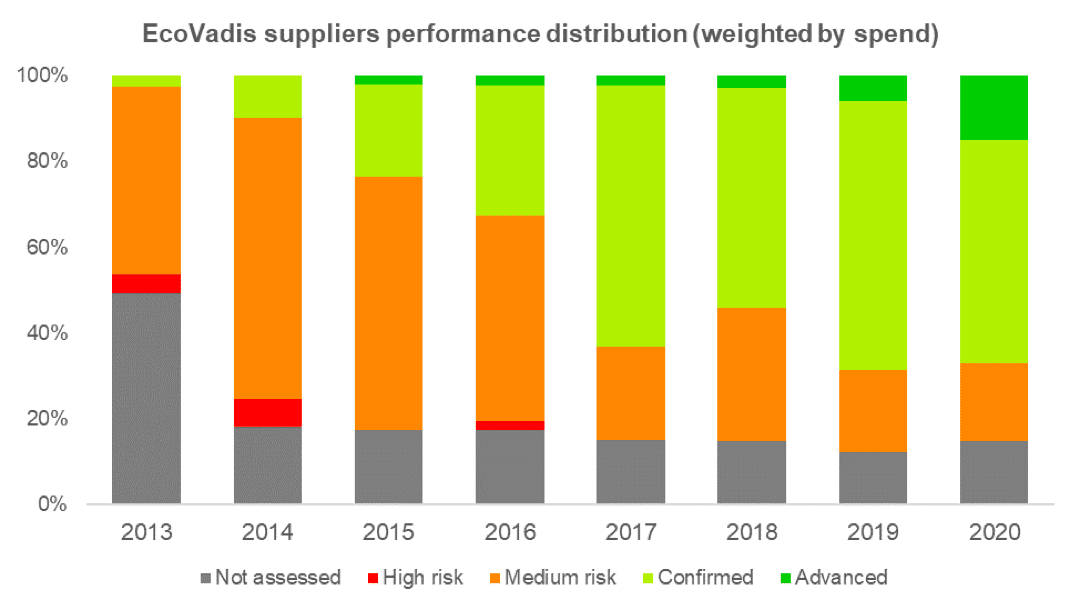

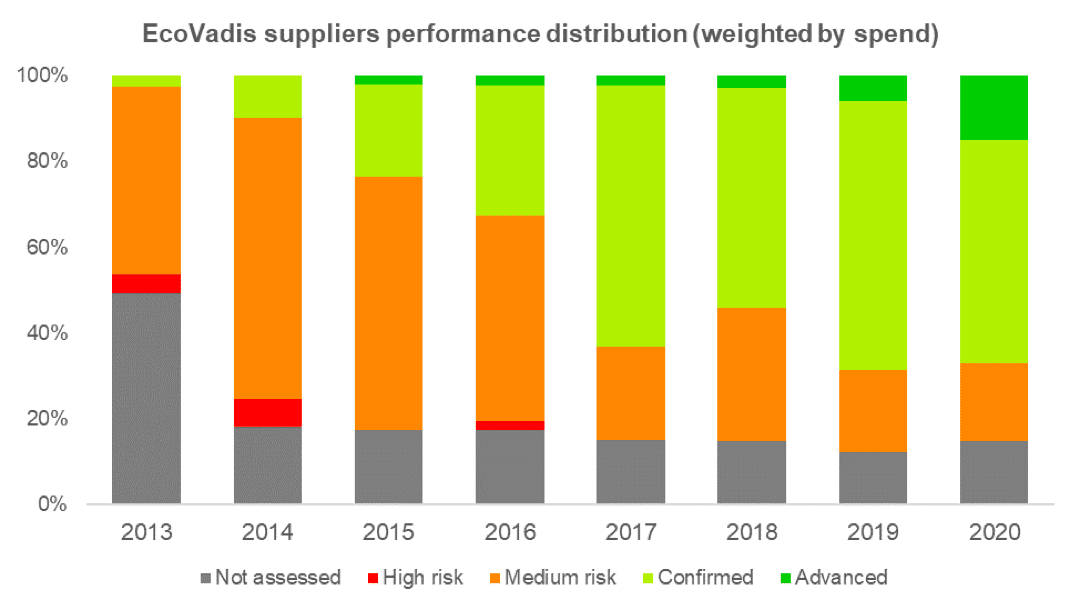

According to the EcoVadis scoring methodology, a score of 45 and above indicates that a company has a ‘confirmed’ performance and is likely to be engaged, with a ‘structured and proactive CSR approach’ and ‘having policies and tangible actions on major issues’. Where suppliers have scored below 45, Michelin requires them to draft and implement a corrective action plan, with special attention paid to themes that have particularly low scores. Michelin has drastically increased coverage of its supply under assessment from around 50% in 2013 to more than 85% in 2020. In 2020, 67% of its supply (weighted by spend in the prior year) was assessed to be of ‘confirmed’ performance by EcoVadis

The EcoVadis platform is able to provide a high-level overview of supplier performance and allows us to identify priority suppliers for engagement quickly. At the same time, the platform allows users to drill down to a high level of detail. Scores can be analyzed by theme to identify specific areas that require additional work. For example, in early rounds of EcoVadis assessments, it was found that ‘Sustainable Procurement’ scores were low, a reflection of the complex supply chains inherent to natural rubber production. This helped to spur the development of the Rubberway solution as a tool that would be helpful not only to Michelin but also to its suppliers. Other trends, such as the inconsistent level of maturity in Environment and Labor and Human Rights pillars, have spurred us to implement not only reactive actions like requiring corrective action plans, but also systems-based approaches to improve performance. One significant activity has been a pilot to expand the Michelin on site supplier audit to include environment and social aspects, such as wastewater treatment performance benchmarked against national or regional standards and a health and safety checklist. The pilot was launched in 2018 and the new aspects will be formalized across all audits by 2021

INCREASING THE TRANSPARENCY OF THE UPSTREAM NATURAL RUBBER SUPPLY CHAIN

One of the biggest challenges facing the natural rubber industry on its journey toward sustainability is the highly fragmented natural rubber supply chain. The challenge arises not only from that fact that 85% of the global natural rubber supply originates from 6 million smallholder farms, but also from the multiple tiers of intermediates that buy and sell natural rubber between farmers and natural rubber processing factories. In Thailand and Indonesia, that together represent 60% of world production, it is common for natural rubber processing factories to source raw material through intermediary dealers three or more layers deep. This results in a very complex supply chain, with a single natural rubber processing factory often having thousands of potential smallholder farmers in their supply shed, most of whom they have little to no direct interaction with.

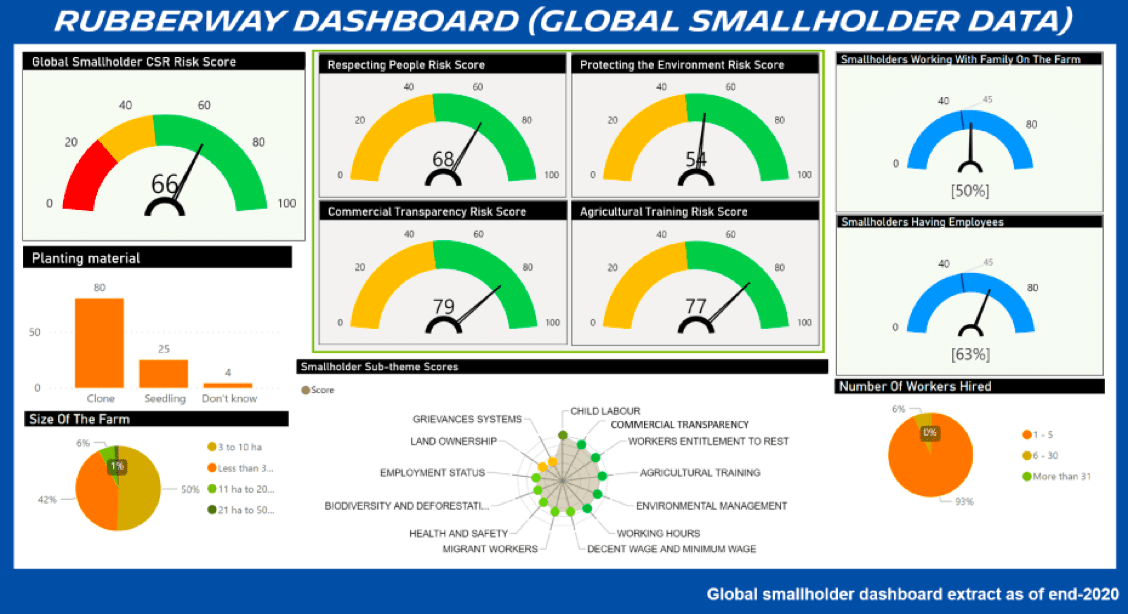

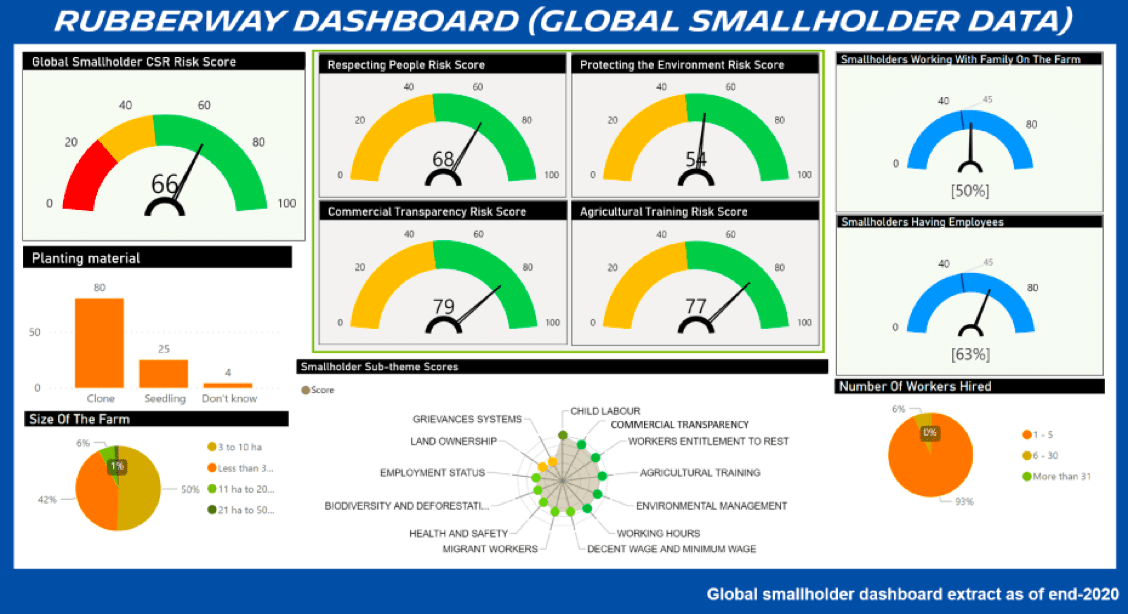

Developed to help tackle this challenge, Michelin developed Rubberway®, a digital solution to assess and map social and environmental risks throughout the natural rubber supply chain. Central to the solution is the Rubberway web-based mobile application, which leverages a device readily available to most factory staff and many farmers: a mobile phone. Using any web-capable mobile device, rubber suppliers and farmers can answer a structured questionnaire that surveys them on environmental, social and agricultural practices. This is typically facilitated by a natural rubber processing factory, who can either survey farmers directly, or through engagement with intermediary dealers.

From there, data points are then aggregated on a web-based dashboard, which generates risk scores from groups of data for statistical analysis. Data can be visualized at multiple scales, from a single factory’s supply shed, to an interactive world map that can identify risks at jurisdictional levels. This data can be used by individual natural rubber processing factories, or downstream actors like tire makers to better understand their supply chain. The outcome is that stakeholders (tire makers, natural rubber processors, etc.) are equipped with the information they need to identify and mitigate risks with specific interventions.

Rubberway has been operational since 2017 and is already used in the main rubber producing countries (including Thailand, Indonesia, Ivory Coast, Nigeria, Ghana and Brazil). More recently in 2019, amidst an industry-wider push for greater transparency in the natural rubber supply chain, Michelin, Continental AG, and Smag announced the creation of a joint venture to further develop Rubberway. The joint venture aims to create an independent solution that can be widely applied across the natural rubber supply chain and hopes to engage more actors to participate in the platform. Today, Rubberway has generated 1.5 million datapoints, and has collected data from more than 40,000 smallholders, meaning that it hosts the most comprehensive dataset relating to natural rubber smallholders.

Michelin believes that it now has sufficient data to begin preliminary identification of priority areas for intervention and as of end-2020, is embarking on a risk-mitigation project, named “CASCADE”, which is targeting selected jurisdictions in Central Sumatra, Indonesia.

Engaging and Assessing our Natural Rubber Supply Chain

Engaging and Assessing our Natural Rubber Supply Chain

RESPONSIBLE RESILIENT NATURAL RUBBER

RESPONSIBLE RESILIENT NATURAL RUBBER

Supply chain assessments are an essential means of ensuring the implementation of Michelin’s Sustainable Natural Rubber Policy. To that end, Michelin has championed the adoption and even the creation of scalable assessment frameworks that are able to be used by a large proportion of the industry.

Supply chain assessments are an essential means of ensuring the implementation of Michelin’s Sustainable Natural Rubber Policy. To that end, Michelin has championed the adoption and even the creation of scalable assessment frameworks that are able to be used by a large proportion of the industry.

DIRECT SUPPLIER ASSESSMENTS

DIRECT SUPPLIER ASSESSMENTS

Michelin procures most of its natural rubber from independent suppliers. Collectively, independent natural rubber processing factories, groups of factories and traders buying from factories are known as direct or Tier 1 suppliers. In every case, Michelin conducts on-site audits, which through a successful pilot will now include environmental and labor aspects from 2021, on individual natural rubber processing factories before they are added to an approved factory list, and on a regular basis afterwards.

To holistically assess the majority of suppliers on their sustainability maturity, Michelin chose to leverage EcoVadis, a global business sustainability ratings provider to assess its direct suppliers in 2013. EcoVadis assesses the maturity of actions and systems related to sustainability by scoring the performance of suppliers in four themes: Environment; Labor and Human rights; Ethics and Sustainable Procurement. These assessments help Michelin to understand relative risk among its supply base and identify suppliers with weaker performance so that they can implement improvement plans. As a result of close engagement with suppliers and by championing the use of a common tool among the industry, EcoVadis assessments are now widely used across the natural rubber supply chain.

Michelin procures most of its natural rubber from independent suppliers. Collectively, independent natural rubber processing factories, groups of factories and traders buying from factories are known as direct or Tier 1 suppliers. In every case, Michelin conducts on-site audits, which through a successful pilot will now include environmental and labor aspects from 2021, on individual natural rubber processing factories before they are added to an approved factory list, and on a regular basis afterwards.

To holistically assess the majority of suppliers on their sustainability maturity, Michelin chose to leverage EcoVadis, a global business sustainability ratings provider to assess its direct suppliers in 2013. EcoVadis assesses the maturity of actions and systems related to sustainability by scoring the performance of suppliers in four themes: Environment; Labor and Human rights; Ethics and Sustainable Procurement. These assessments help Michelin to understand relative risk among its supply base and identify suppliers with weaker performance so that they can implement improvement plans. As a result of close engagement with suppliers and by championing the use of a common tool among the industry, EcoVadis assessments are now widely used across the natural rubber supply chain.

RESPONSIBLE PROCESSING AND PRODUCTION

RESPONSIBLE PROCESSING AND PRODUCTION

According to the EcoVadis scoring methodology, a score of 45 and above indicates that a company has a ‘confirmed’ performance and is likely to be engaged, with a ‘structured and proactive CSR approach’ and ‘having policies and tangible actions on major issues’. Where suppliers have scored below 45, Michelin requires them to draft and implement a corrective action plan, with special attention paid to themes that have particularly low scores. Michelin has drastically increased coverage of its supply under assessment from around 50% in 2013 to more than 85% in 2020. In 2020, 67% of its supply (weighted by spend in the prior year) was assessed to be of ‘confirmed’ performance by EcoVadis

According to the EcoVadis scoring methodology, a score of 45 and above indicates that a company has a ‘confirmed’ performance and is likely to be engaged, with a ‘structured and proactive CSR approach’ and ‘having policies and tangible actions on major issues’. Where suppliers have scored below 45, Michelin requires them to draft and implement a corrective action plan, with special attention paid to themes that have particularly low scores. Michelin has drastically increased coverage of its supply under assessment from around 50% in 2013 to more than 85% in 2020. In 2020, 67% of its supply (weighted by spend in the prior year) was assessed to be of ‘confirmed’ performance by EcoVadis

The EcoVadis platform is able to provide a high-level overview of supplier performance and allows us to identify priority suppliers for engagement quickly. At the same time, the platform allows users to drill down to a high level of detail. Scores can be analyzed by theme to identify specific areas that require additional work. For example, in early rounds of EcoVadis assessments, it was found that ‘Sustainable Procurement’ scores were low, a reflection of the complex supply chains inherent to natural rubber production. This helped to spur the development of the Rubberway solution as a tool that would be helpful not only to Michelin but also to its suppliers. Other trends, such as the inconsistent level of maturity in Environment and Labor and Human Rights pillars, have spurred us to implement not only reactive actions like requiring corrective action plans, but also systems-based approaches to improve performance. One significant activity has been a pilot to expand the Michelin on site supplier audit to include environment and social aspects, such as wastewater treatment performance benchmarked against national or regional standards and a health and safety checklist. The pilot was launched in 2018 and the new aspects will be formalized across all audits by 2021

The EcoVadis platform is able to provide a high-level overview of supplier performance and allows us to identify priority suppliers for engagement quickly. At the same time, the platform allows users to drill down to a high level of detail. Scores can be analyzed by theme to identify specific areas that require additional work. For example, in early rounds of EcoVadis assessments, it was found that ‘Sustainable Procurement’ scores were low, a reflection of the complex supply chains inherent to natural rubber production. This helped to spur the development of the Rubberway solution as a tool that would be helpful not only to Michelin but also to its suppliers. Other trends, such as the inconsistent level of maturity in Environment and Labor and Human Rights pillars, have spurred us to implement not only reactive actions like requiring corrective action plans, but also systems-based approaches to improve performance. One significant activity has been a pilot to expand the Michelin on site supplier audit to include environment and social aspects, such as wastewater treatment performance benchmarked against national or regional standards and a health and safety checklist. The pilot was launched in 2018 and the new aspects will be formalized across all audits by 2021

INCREASING THE TRANSPARENCY OF THE UPSTREAM NATURAL RUBBER SUPPLY CHAIN

INCREASING THE TRANSPARENCY OF THE UPSTREAM NATURAL RUBBER SUPPLY CHAIN

One of the biggest challenges facing the natural rubber industry on its journey toward sustainability is the highly fragmented natural rubber supply chain. The challenge arises not only from that fact that 85% of the global natural rubber supply originates from 6 million smallholder farms, but also from the multiple tiers of intermediates that buy and sell natural rubber between farmers and natural rubber processing factories. In Thailand and Indonesia, that together represent 60% of world production, it is common for natural rubber processing factories to source raw material through intermediary dealers three or more layers deep. This results in a very complex supply chain, with a single natural rubber processing factory often having thousands of potential smallholder farmers in their supply shed, most of whom they have little to no direct interaction with.

Developed to help tackle this challenge, Michelin developed Rubberway®, a digital solution to assess and map social and environmental risks throughout the natural rubber supply chain. Central to the solution is the Rubberway web-based mobile application, which leverages a device readily available to most factory staff and many farmers: a mobile phone. Using any web-capable mobile device, rubber suppliers and farmers can answer a structured questionnaire that surveys them on environmental, social and agricultural practices. This is typically facilitated by a natural rubber processing factory, who can either survey farmers directly, or through engagement with intermediary dealers.

From there, data points are then aggregated on a web-based dashboard, which generates risk scores from groups of data for statistical analysis. Data can be visualized at multiple scales, from a single factory’s supply shed, to an interactive world map that can identify risks at jurisdictional levels. This data can be used by individual natural rubber processing factories, or downstream actors like tire makers to better understand their supply chain. The outcome is that stakeholders (tire makers, natural rubber processors, etc.) are equipped with the information they need to identify and mitigate risks with specific interventions.

One of the biggest challenges facing the natural rubber industry on its journey toward sustainability is the highly fragmented natural rubber supply chain. The challenge arises not only from that fact that 85% of the global natural rubber supply originates from 6 million smallholder farms, but also from the multiple tiers of intermediates that buy and sell natural rubber between farmers and natural rubber processing factories. In Thailand and Indonesia, that together represent 60% of world production, it is common for natural rubber processing factories to source raw material through intermediary dealers three or more layers deep. This results in a very complex supply chain, with a single natural rubber processing factory often having thousands of potential smallholder farmers in their supply shed, most of whom they have little to no direct interaction with.

Developed to help tackle this challenge, Michelin developed Rubberway®, a digital solution to assess and map social and environmental risks throughout the natural rubber supply chain. Central to the solution is the Rubberway web-based mobile application, which leverages a device readily available to most factory staff and many farmers: a mobile phone. Using any web-capable mobile device, rubber suppliers and farmers can answer a structured questionnaire that surveys them on environmental, social and agricultural practices. This is typically facilitated by a natural rubber processing factory, who can either survey farmers directly, or through engagement with intermediary dealers.

From there, data points are then aggregated on a web-based dashboard, which generates risk scores from groups of data for statistical analysis. Data can be visualized at multiple scales, from a single factory’s supply shed, to an interactive world map that can identify risks at jurisdictional levels. This data can be used by individual natural rubber processing factories, or downstream actors like tire makers to better understand their supply chain. The outcome is that stakeholders (tire makers, natural rubber processors, etc.) are equipped with the information they need to identify and mitigate risks with specific interventions.

Rubberway has been operational since 2017 and is already used in the main rubber producing countries (including Thailand, Indonesia, Ivory Coast, Nigeria, Ghana and Brazil). More recently in 2019, amidst an industry-wider push for greater transparency in the natural rubber supply chain, Michelin, Continental AG, and Smag announced the creation of a joint venture to further develop Rubberway. The joint venture aims to create an independent solution that can be widely applied across the natural rubber supply chain and hopes to engage more actors to participate in the platform. Today, Rubberway has generated 1.5 million datapoints, and has collected data from more than 40,000 smallholders, meaning that it hosts the most comprehensive dataset relating to natural rubber smallholders.

Rubberway has been operational since 2017 and is already used in the main rubber producing countries (including Thailand, Indonesia, Ivory Coast, Nigeria, Ghana and Brazil). More recently in 2019, amidst an industry-wider push for greater transparency in the natural rubber supply chain, Michelin, Continental AG, and Smag announced the creation of a joint venture to further develop Rubberway. The joint venture aims to create an independent solution that can be widely applied across the natural rubber supply chain and hopes to engage more actors to participate in the platform. Today, Rubberway has generated 1.5 million datapoints, and has collected data from more than 40,000 smallholders, meaning that it hosts the most comprehensive dataset relating to natural rubber smallholders.

Michelin believes that it now has sufficient data to begin preliminary identification of priority areas for intervention and as of end-2020, is embarking on a risk-mitigation project, named “CASCADE”, which is targeting selected jurisdictions in Central Sumatra, Indonesia.

Michelin believes that it now has sufficient data to begin preliminary identification of priority areas for intervention and as of end-2020, is embarking on a risk-mitigation project, named “CASCADE”, which is targeting selected jurisdictions in Central Sumatra, Indonesia.

Link copied successfully

Link copied successfully